As part of our marketing efforts for FHA condo project approvals, we work to compile data for condo sales in various towns in Connecticut. We choose towns that have a lot of condominiums to provide comparison data between projects that are FHA approved condos and those that are not. This report combines Southington with its borough of Planstville, CT.

As part of our marketing efforts for FHA condo project approvals, we work to compile data for condo sales in various towns in Connecticut. We choose towns that have a lot of condominiums to provide comparison data between projects that are FHA approved condos and those that are not. This report combines Southington with its borough of Planstville, CT.

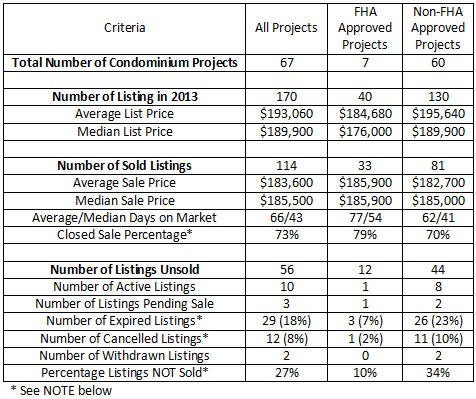

Southington CT Condo Data for 2013

Southington has 67 condominium projects of which 7 of them are approved with FHA. There are four more submissions to FHA that are currently in Rejected status. Before FHA’s changes in 2011 there were 24 projects on FHA’s Approved Condominiums List.

Analysis of Data

I typically divide the listing data into those in FHA-approved condos and those that are in non-FHA projects. For my business, it’s good to analyze the difference between the two.

In Southington, condominiums do not appear to have been difficult to sell in 2013. Roughly 73% of the condo unit listings sold and only 18% expired overall. This is a higher ratio of closed sales than in most of the towns that I have investigated.

The average and median sales prices were comparable between the FHA and non-FHA condominiums as were the average and median active days on the market.

The largest contrast between the FHA and non-FHA projects is in the percentage of expired listings. In non-FHA condominiums, units were three times more likely to expire than those in FHA-approved condominiums.

The closed to expired ratio for Southington is 4:1; in FHA projects it was 11:1 and in non-FHA projects it was only 3:1. As I have seen in the past, this data backs up the statement that units in FHA condominiums are more likely to sell and less likely to expire than in non-FHA projects.

One interesting point worth mentioning is the average sales price of units in FHA projects was around $186,000. In one FHA-approved condominium, the lowest sale price was $250,000 AND the FHA concentration is 20% in this project. This is one example to help dispel the myth that FHA is for low-income borrowers.

Difficulty in compiling the data for Southington occurred because of a large group of condominiums called Spring Lake Village. There are 9 communities in Spring Lake and the MLS did not show in which of the 9 separate condominiums the listing was located. Only 2 of the 9 are approved with FHA and one expired 10/18/13.

*NOTE: Closed, Expired and Cancelled listing percentages are calculated by removing the currently Active and Pending Sale data to account only for listings that are no longer on the market. This is why the percentage of closed sales plus the percentage of NOT closed sales does not equal 100%. There are currently 13 units still on the market that were listed during 2013.

Real estate agent Minna Reid posted a nice year-over-year comparison of condo sales prices for Southington.

Related Articles:

East Hartford Condo Sales 2013

Condominium Market Data for Ellington, CT

Condominium Market Data for Bristol, CT

2013 Q4 Market Data for Newington, CT

2013 Q4 Market Data for Enfield, CT

2013 Q4 Market Data for Vernon, CT

2013 Q4 Market Data for South Windsor, CT

2013 Q4 Market Data for Manchester, CT

Top Photo Credit: (c) Can Stock Photo / elxeneize